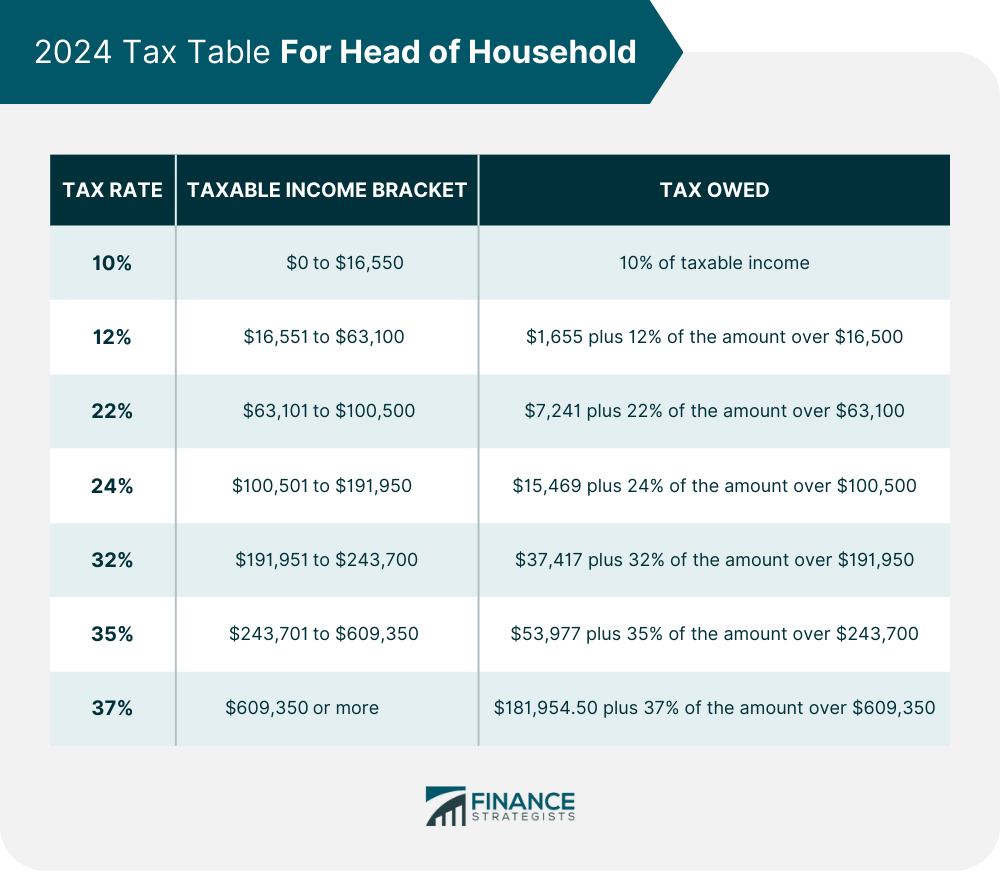

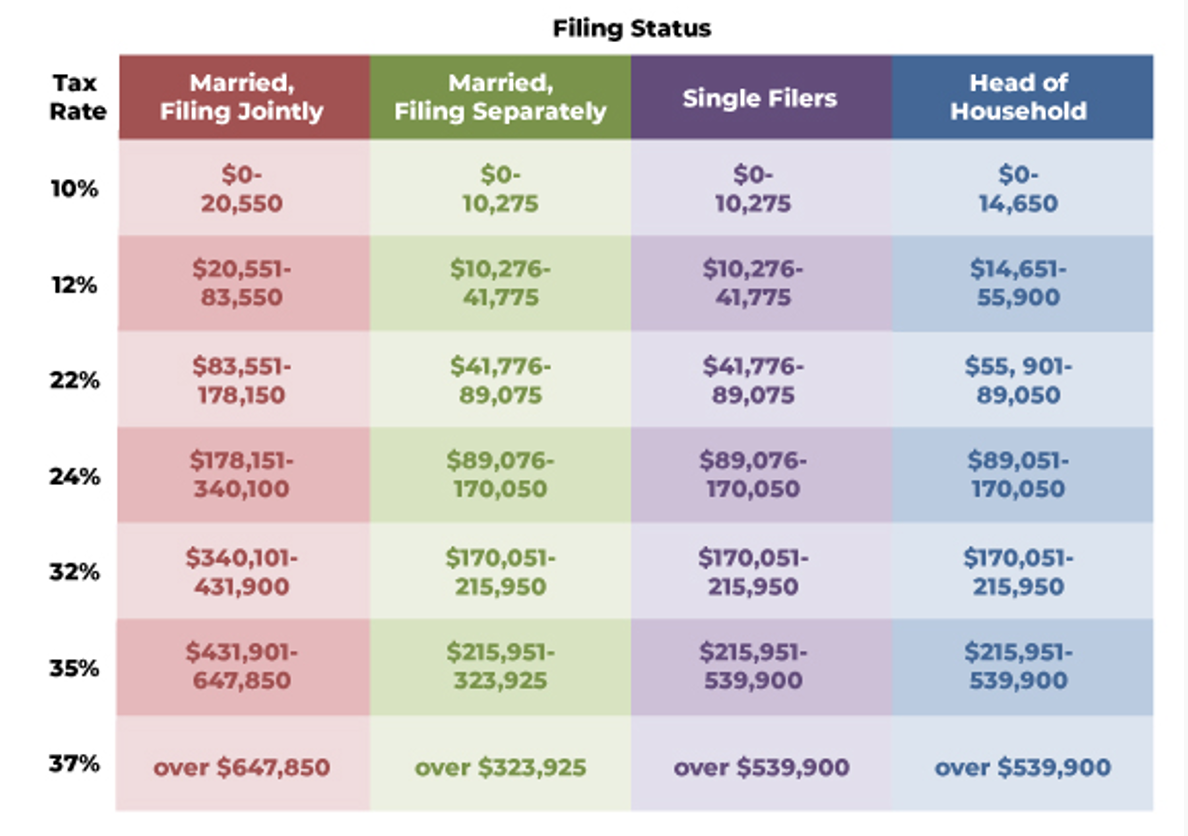

Tax Brackets For 2025 Head Of Household And Single. Head of household filers have more generous tax brackets than single or married filing separately. Head of household filing status has two main advantages over filing single or married filing separately—more of your taxable income falls under lower tax brackets and you.

See current federal tax brackets and rates based on your income and filing status. Tax brackets and tax rates.

Irs Tax Bracket 2025 Head Of Household Chanda Kyrstin, Married couples filing separately and head of household filers;

2025 Tax Brackets Single Chart Sara Wilone, Your tax bracket depends on your taxable income and your filing status:

Irs Tax Bracket 2025 Head Of Household Chanda Kyrstin, Here are the 2025 federal tax brackets.

Tax Calculator 2025 With Dependents Irena Saloma, For 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Tax Brackets Definition, Types, How They Work, 2025 Rates, Tax rate taxable income (married filing separately) taxable income (head of household)) 10%:

Tax Bracket 2025 Head Of Household Calculator Bobbie Margit, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

2025 Tax Brackets Chart Ami Lindsay, Your bracket depends on your taxable income and filing status.

Tax Brackets 2025 Head Of Household Corri Doralin, To figure out your tax bracket, first look at the rates for the filing status you plan to use:

A Guide to the 2025 Federal Tax Brackets Priority Tax Relief, Let’s say for the 2025 tax year (filing in 2025), you earned a taxable income of $90,000, and you filed as single.